AI-Powered Drug Discovery Platforms – From Molecules to Medicines

Traditionally, Software investors have kept their distance from the Biotechnology and Pharmaceutical sectors. But lately, interest in these fields has surged, especially where Artificial Intelligence is involved. Suddenly, investing in protein folding technologies or Drug Discovery platforms built on AI isn’t just trendy, it’s considered visionary. While some of the buzz may stem from the “.ai” branding, the deeper reason is the genuine potential for AI to revolutionize Drug Development. Tools like DeepMind’s AlphaFold have already made waves among researchers, and startups are now leading the next phase of innovation.

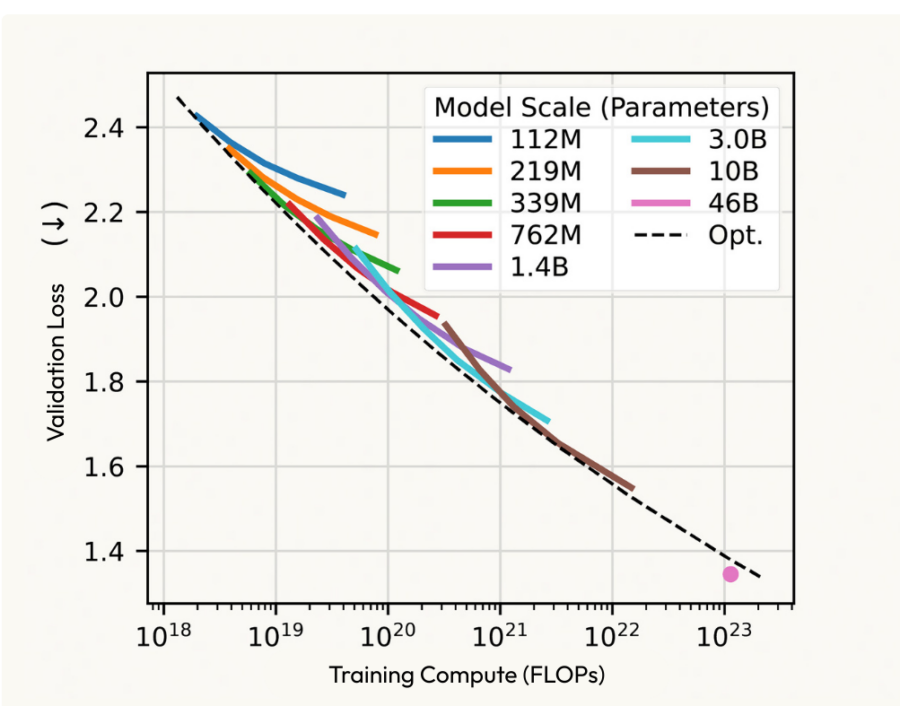

The logic behind this interest is straightforward. Biological sequences such as DNA, RNA, proteins, and even chemical compounds share a structured, encoded nature similar to language. AI models designed initially for natural language processing, especially transformer architectures, have proven surprisingly adept at modeling these biological systems. As these models demonstrate similar performance improvements to Large Language Models (LLMs), it’s tempting to believe that the AI-driven transformation of Biotechnology is inevitable. However, History urges caution.

Compute-optimal scaling of model capacity & training data from Profluent Bio’s ProGen3

AI Meets Biology: A Natural Fit

The idea of applying AI to Biology isn’t as far-fetched as it once seemed. Biological systems such as DNA, RNA, and proteins are fundamentally encoded as sequences, much like language. The rise of LLMs and transformer-based architectures has demonstrated a powerful capacity to model and generate sequences with accuracy and efficiency. As it turns out, these same principles can be applied to biological molecules.

The potential here is enormous. Just as LLMs improved by scaling Data and Compute, AI models in Biology are beginning to show similar scaling behavior. For investors and entrepreneurs, the opportunity is clear: the upside in Biotechnology is vast, and AI may finally offer a way to unlock it faster, cheaper, and more efficiently. Yet, despite the enthusiasm, the harsh realities of the industry remain.

A History of Caution: Why the Biotech Dream Often Fails

AI-Powered Drug Discovery Platforms

This isn’t the first time Technology has tried to reshape Biotechnology. The Human Genome Project in the early 2000s sparked a wave of Genomics and data companies like Celera and Gene Logic. AI-focused startups had their moment, too. But time and again, these ventures faced the same barriers: Drug Development is expensive, slow, and riddled with uncertainty. Moreover, the software business model—scalable, repeatable, and high-margin—doesn’t fit neatly into the high-risk, asset-heavy nature of biotech.

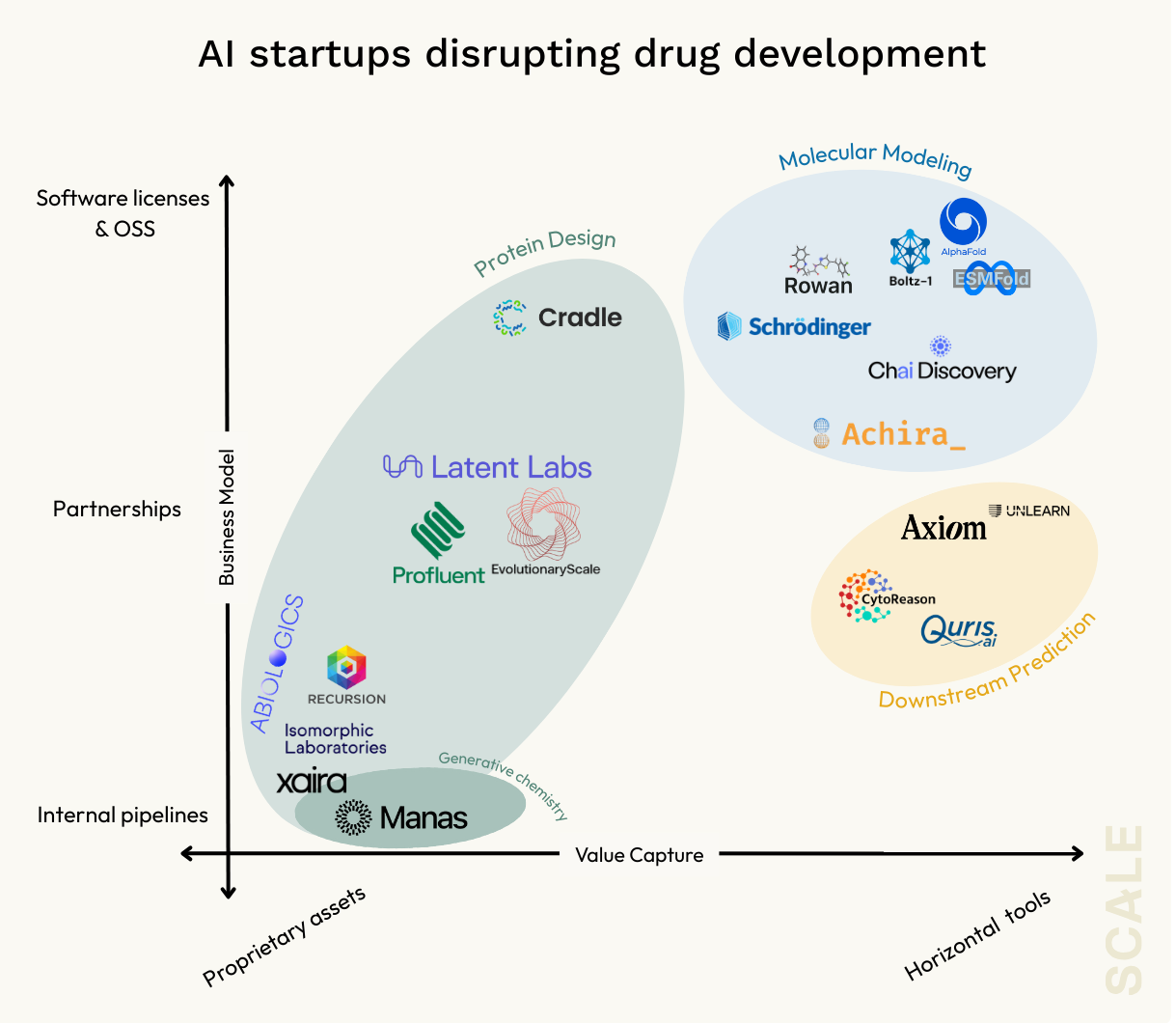

A key lesson from the past is that true commercial success in biotech rarely comes from selling Software tools alone. Take Schrödinger, for instance. Despite building one of the most powerful Computational Modeling platforms, it struggled to scale on Software revenue alone. Eventually, it had to develop its own drug pipeline to justify its valuation and commercial strategy. The message is clear: in Biotechnology, value typically accrues to physical drug assets, not the software used to develop them.

Why AI in Drug Discovery Could Be Different This Time

AI-Powered Drug Discovery Platforms

Despite this sobering History, there are good reasons to believe that AI’s role in Drug Discovery today might evolve differently. It’s not just about smarter models, although that’s part of it. It’s about a possible shift in how Software tools are adopted, used, and monetized in the Life Sciences sector.

Today’s AI tools are beginning to demonstrate real utility beyond basic research. Rather than promising novel Biological discoveries alone (which still require years of validation), these tools are helping to streamline bottlenecks, reduce R&D costs, and improve success rates across the entire Drug Development lifecycle. That changes the commercial equation in important ways.

AlphaFold 2: A Turning Point in Scientific AI

AlphaFold 2, developed by DeepMind, signaled a major leap in what AI could do for biology. Predicting a protein’s 3D structure had historically taken months and required costly lab equipment. AlphaFold allowed scientists to make accurate predictions in minutes at a fraction of the cost. While not perfect (it still doesn’t replace experimental validation), AlphaFold shifted the industry’s expectations around Computational Biology.

More importantly, DeepMind released AlphaFold as open-source, forcing Pharmaceutical companies to adapt quickly without relying on a sales team to integrate it. As a result, companies had to build in-house talent to implement and use these models. This growing base of technically savvy Pharmaceutical professionals may pave the way for future AI tools to gain faster adoption and commercial traction.

Platform Plays vs. Point Solutions: A New Commercial Strategy

Historically, Biotechnology startups focused on “platform plays”—building Technology that could produce a broad pipeline of drug candidates—have found more success than those offering point solutions or software tools. Moderna’s mRNA platform and Millennium’s Genomic discoveries are classic examples. These companies licensed their platforms to major Pharmaceutical players while simultaneously building internal drug pipelines.

The same model is being adopted by many AI-native Biotechnology startups today. Instead of selling Software, these companies build powerful Drug Discovery platforms and then monetize them through strategic partnerships, co-development deals, and equity-based collaborations with big Pharmaceuticals. Even antibody discovery firms like Adimab and AbCellera followed this path. However, their financial success depended heavily on revenue-sharing and milestone-based royalties—models that remain unpredictable and difficult to scale.

Beyond AlphaFold: What Comes Next in AI for Biotech

AlphaFold 2 tackled static protein structures, but most biologically relevant interactions are dynamic. To understand how a drug might bind, activate, or inhibit a protein in real-world conditions, scientists need tools for simulating complex molecular interactions over time.

That’s where the next generation of AI models is headed. AlphaFold 3 (developed by DeepMind spinout Isomorphic) and startups like Achira are venturing into physics-informed simulations incorporating quantum chemistry and molecular dynamics. These advanced models go far beyond folding—they aim to predict how proteins and small molecules interact, how those interactions evolve in different environments, and how side effects might arise.

However, commercial success in this arena still hinges on whether these tools deliver real competitive advantages compared to open-source solutions or internal Pharmaceutical R&D teams. Schrödinger’s experience serves as a cautionary tale – Pharmaceutical companies do spend billions on these workflows, but they’re hesitant to buy Software unless it’s demonstrably better than what they can build themselves.

Shifting Economics of AI in Biotech

There are signs that the economy may be shifting. Unlike AlphaFold 2, AlphaFold 3 has been released without a commercial use license, which suggests that AI models in biotech may increasingly be monetized instead of given away freely. As models grow more complex and expensive to run, buyers may find it easier to pay the developer rather than build their own infrastructure. This mirrors patterns seen in other industries where open-source eventually gives way to proprietary, cloud-based solutions.

Still, this is a field heavily reliant on public and nonprofit funding, which means competition from open-source projects will likely remain fierce. For AI startups, succeeding in Biotechnology will depend on whether they can provide truly differentiated, proprietary capabilities—not just a repackaging of what’s already available for free.

New Frontiers: Downstream Testing and Predictive Modeling

Another major frontier for AI is in Downstream applications – predicting efficacy, safety, and side effects before a drug enters Clinical Trials. Despite decades of effort, 90% of clinical-stage drugs still fail, mostly due to issues that only surface after millions have already been invested.

AI models trained on clinical, molecular, and real-world data could help flag potential red flags earlier in the pipeline. If these tools can reduce failure rates even marginally, they could unlock billions in value. This area is already seeing startup activity, with new companies building predictive models that help triage drug candidates before expensive trials begin.

Final Thoughts: Is This Time Really Different?

The past has shown that selling software to pharma isn’t easy. Investors who dive into AI-driven biotech should know the sector’s historical pitfalls. Still, the convergence of improved AI models, a more technically adept buyer base, and structural bottlenecks in drug development offers hope that the industry might finally be ready for a new model of value creation.